The Future of Best Execution?

Tomorrow belongs to those who prepare for it today

Malcolm X

In years to come it feels we will probably look back at this period of history in the financial markets and recognise that this era was defined by incredibly rapid change, driven largely by technology. The democratisation of computing via the cloud, providing accessibility to cheaper, faster processing power is allowing the financial markets to harness the vast amounts of data produced and stored every day. This is not only delivering the ability to harness ‘big data’, but more importantly in our view, turn these vast data pools/lakes/oceans into actionable ‘smart data’.

So, what has any of this to do with Best Execution? Well, in this article we explore where we think the future of Best Execution may evolve, driven by this increasingly accessible technology, data and analytics.

The Present

Before we embark upon envisioning the future, lets recap on the present. To clarify what we are talking about it is worth reiterating the definition of best ex, at least from a regulatory perspective. MiFID II uses the following definition:

“A firm must take all sufficient steps to obtain, when executing orders, the best possible results for its clients taking into account the execution factors.

The execution factors to be taken into account are price, costs, speed, likelihood of execution and settlement, size, nature or any other consideration relevant to the execution of an order.”

Source: article 27(1) of MiFID

How does this regulatory definition translate in practice? In our view, best ex can be summarised from a practical perspective via the following, many of which we have explored in detail in previous articles:

· Best execution is a process

· Covers lifecycle of a trade, from order inception, through execution to settlement

· Requires a documented best execution policy, covering both qualitative and quantitative elements

· Process needs to measure and monitor the execution factors relevant to a firm’s business

· Any outlier trades to the policy need to be identified, understood and approved

· Requires continual performance assessment, learning and process enhancement, i.e. a best ex feedback loop

Our experience indicates that there is a wide spectrum of sophistication with regards to the implementation of best execution policies and monitoring. However, there are institutions at the ‘cutting edge’, who are clearly helping define the direction of travel for best execution in the future. As already discussed, technology, data and analytics are key enablers here, but the over-arching driver for change is the pressure on returns and need to control costs. This is resulting in the need for execution desks to increasingly automate workflows where possible as fewer traders are asked to trade more tickets, more products, navigate increasingly complex market structures and utilise a wider array of execution protocols and methods. With this in mind, it helps craft a vision of where best execution may evolve over the next decade.

The Future

To structure the vision, we define the process of best execution process into the following 3 components:

1. Order Inception

2. Order Execution

3. Execution Measurement

A general statement to kick off is that we feel the trend for flow to be split between high and low touch will continue, and this bifurcation will run as a theme throughout the future state. Traders will have to prioritise the tickets that require their attention, which may be the larger trades, the more complex trades, the less liquid etc. Broadly speaking, such trades will be defined as ‘High Touch’, and everything else will fall into the ‘Low Touch’ category. The rules for defining the boundary between high and low will obviously vary considerably by institution and will be a function of the size and complexity of the business, the number of available traders and the strategic desire, or not, to automate.

1. Order Inception

As summarised in the figure below, we anticipate that at the order inception stage, there will be a differentiation in high vs low touch orders in that the former will be generally subjected to some form of pre-trade modelling to help optimise the execution approach.

Such pre-trade modelling will ultimately be carried out at a multi-asset level, where appropriate, such that an originating portfolio manager would be able to assess the total cost of the order at inception, including any required FX funding or hedging, as illustrated in the example below:

A natural consequence of such pre-trade modelling at inception is the evolution of the relationship between the portfolio manager and execution desk, whereby the traders become ‘execution advisors’, having a proactive dialogue with the manager on the optimal execution approach to be adopted, via a combination of market experience and analytics.

Clearly, low touch flow would not follow the same protocols. Here it is likely that rules will be deployed to determine the optimal execution method, again driven by analytics and empirical evidence. However, it is still potentially relevant to have pre-trade estimates computed and stored to allow an ex-post comparison, which may be valuable over time to help refine the rules via ongoing monitoring and feedback.

2. Order Execution

Moving to actual execution, the pre-trade work done for high touch flow clearly allows informed decisions to be made, that are defensible and can be justified to best ex oversight committees, asset owners and regulators.

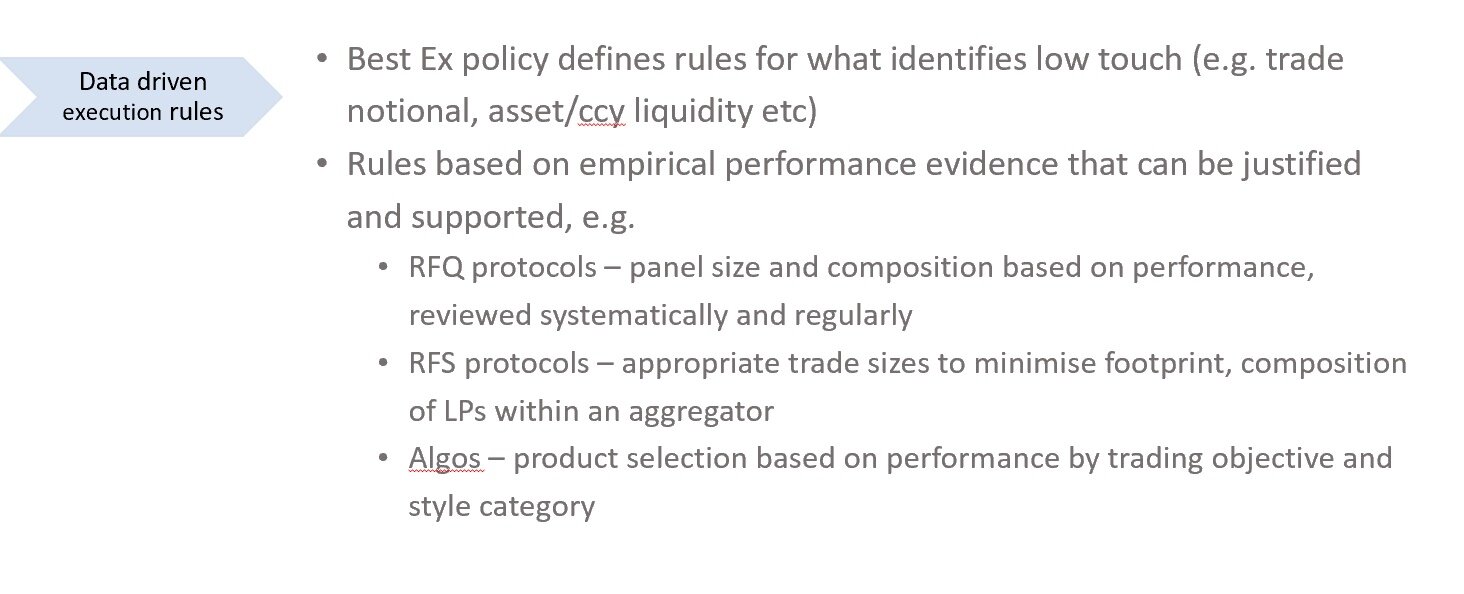

The definition of execution rules for low touch, based on objective analytics and empirical evidence, also allow such justification to be carried out. Some examples are provided below:

Trader oversight is obviously going to remain critical, allowing over-rides of rules at any point to accommodate specific market conditions on any given day. In addition, a key component will be to rigorously monitor the performance of the pre-trade modelling for high touch, and also the rules for defining execution methods for low touch. This performance monitoring, defined to focus on the execution objectives relevant for the institution in question, and will require a regular review of outcomes to establish if changes need to be made to any of the rules.

3. Execution Measurement

Monitoring and measurement of performance will be carried out at 2 levels: tactical and strategic. Tactical is required on a timely basis, and we would envisage the future state for this would be real-time, or near to real-time, which allows every trade to be monitored, both high and low touch, to identify any outliers to the best ex policy.

Strategic monitoring would be a more systematic measurement of performance over large, statistically significant data samples. Clearly, the frequency of this will be dictated somewhat by how active a given institution is e.g. smaller institutions may not generate enough trades to have a large enough sample to draw conclusions from, say, quarterly analysis. Larger, more active institutions may find that monthly reviews are appropriate. Clearly, market conditions may also dictate adhoc reviews, e.g. counterparty defaults, market structure changes, financial crises etc. However, whatever the frequency, it is essential that systematic oversight is required to ensure that the rules coded to drive the bulk of execution are producing satisfactory and optimal results. The old cliché of you can only manage what you can measure is never truer than in this particular case.

Conclusion

Although the future state we envisage in this article may take a number of years to evolve, and indeed, may evolve in a very different form, there are a number of trends that are already observable in the industry which indicate that significant change is coming.

Across both the buy and sell side, the trend to do ‘more with less’ feels unstoppable, and this will result in an increased deployment of technology and automation. However, we don’t anticipate a totally AI driven world, ‘staffed’ by trading bots. The random nature of financial markets makes it impossible to code for every eventuality, and this won’t change. Market experience and human oversight will always be required, albeit as we have indicated, traders are having to trade more tickets, be responsible for more products, whilst navigating more complex market structure and increased number of execution protocols and products.

At the core of this future state will be data driven insights and analytics, which will also satisfy the ever-increasing governance demands and evidencing of best execution, from both regulators and asset owners.