Liquidity & Execution Style Trends

Great things are not accomplished by those who yield to trends and fads and popular opinion.

Jack Kerouac

In this short article we thought it would be interesting to highlight some trends that we are observing across the FX market with respect to liquidity and execution style. We particularly focus on a couple of the common themes, discussed ad nauseam on panels at the various industry conferences, namely:

- Fragmentation – is this really happening or not?

- Is the nature of liquidity changing?

- Algos – is their usage increasing or not?

- What are the most commonly traded algo types?

Fragmentation

We analysed the distinct number of ‘venues’ that have been tagged in trade data that BestX has analysed over the last couple of years. Given the lack of consistency in naming conventions it is difficult to provide a precise analysis e.g. some venues were tagged using codes that were either impossible to interpret or simply classified by the liquidity provider as ‘other’. In addition, it is rarely possible to distinguish between a ‘venue’ that is simply a liquidity provider’s principal risk stream, and those that are dark pools of client orders allowing true crossing. Finally, all price streams from one liquidity provider are grouped together as one venue.

It is for these reasons that we describe ‘venue’ loosely, i.e.

- an ECN

- a liquidity provider’s principal book (bank and non-bank)

- dark pools or internal matching venues (where identified)

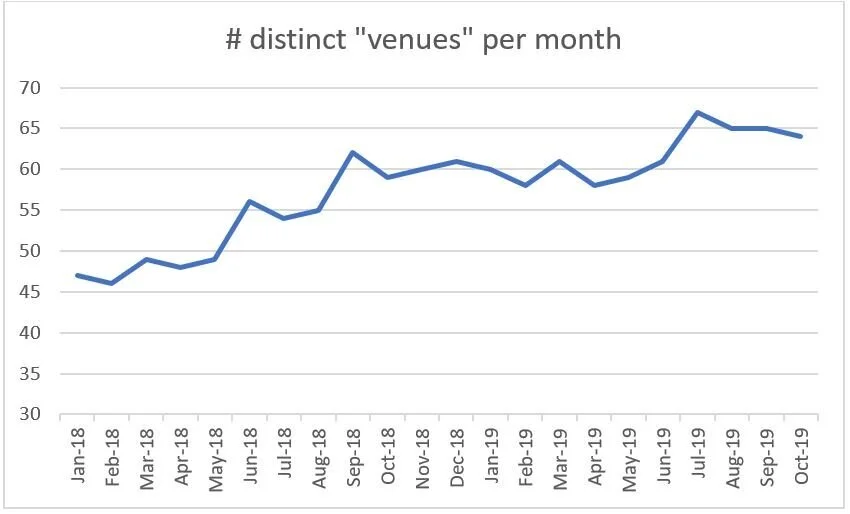

Given these assumptions, the count of distinct venues that BestX has observed since January 2018 on a monthly basis are plotted below, increasing from 47 in January 2018 to a peak of 67 in July 2019. Such fragmentation is also cited in the recent published BIS quarterly review [1].

Please note, that the absolute numbers are probably underestimated given the assumptions mentioned above, and especially due to the number of indistinguishable codes grouped into the ‘Other’ category. However, the trend is clear and, although it is uncertain how much of the increase is due to truly new venues, there is no doubt that algos are increasingly accessing a wider set of liquidity pools.

Liquidity Type

Digging a little deeper, we then explored if the nature of the liquidity that was been accessed was changing. More ‘venues’ doesn’t necessarily mean more liquidity given the issue of recycling, or improved performance, given the possibility of increased signalling risk.

In terms of volumes traded, our dataset confirmed what is widely cited in the trade press, in that the share of volume traded on the primary FX venues is decreasing. The chart below shows the proportion of volume traded in Q1 18 compared to Q1 19, and the primary venue share has fallen from 11% to 8% over this period.

Interestingly, the ‘winners’ over this same period are clearly the bank liquidity pools, which in this dataset are a mixture of electronic market making books and client pools, but in both cases can be classified as ‘dark’. The increase over this period was from 43% to 61%.

The Use of Algos

So, it is clear that the variety of liquidity, and nature of the that liquidity, is changing. We now turn our attention to execution styles, and in particular, focusing on whether the use of algos in FX is increasing or not. Indeed, Greenwich Associates reported recently that they had found FX algo usage had increased by 25% year on year [2]. FX algos have been around for a long time, with some market participants referring to the first algo execution way back in 2004. However, adoption has been slow, with anecdotal evidence indicating that algo volumes have only really started to pick up in the last couple of years.

Our research shows that the % of overall spot volume now traded algorithmically has increased significantly in recent years, as illustrated in the chart below, with algo market share increasing from 26% in 2017 to 39% in 2019 year to date.

There may be some bias in these numbers from an absolute perspective due to the nature of the BestX client base, which tend to be more sophisticated execution desks which are well-versed in the use of algos. The trend, however, is very clear and we have seen evidence of increased algo adoption across the industry, both in terms of increased use by seasoned algo users, and adoption by clients that are new to algos.

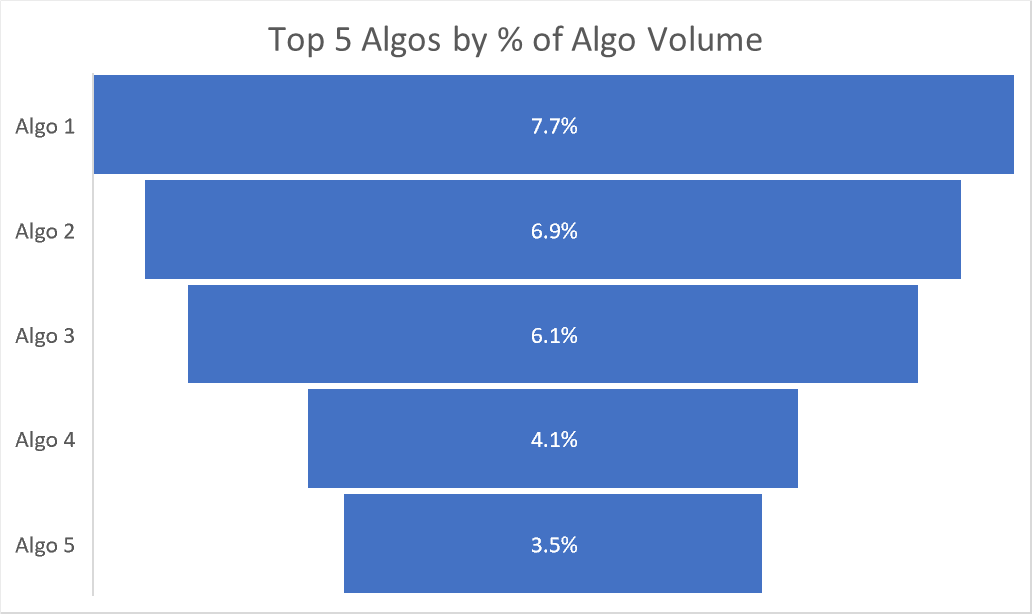

Over the last couple of years, we have seen over 170 different algos used by clients of BestX. The algo type or style that is currently seeing the largest market share is TWAP, with almost 18% of algo volume traded in this style. In terms of market share, the next 5 algos hare approximately 28% of the volume, as illustrated below:

Looking at the volume traded per algo, if we exclude the TWAP category, the average market share is 0.5%, and the distribution of market share has a standard deviation of 1.1%. There is a long tail in the distribution, with the top 20 algos accounting for just under 60% of the volume.

Conclusions

Over recent years the FX market has clearly witnessed a proliferation in the numbers of liquidity ‘venues’ and the number of algorithmic products made available to end investors. Forecasting the future is clearly prone to error, but it feels instinctively that the proliferation is coming to a natural end, and, could possibly reverse given the ever decreasing margins. The issues with phantom and/or recycled liquidity are well known, which indicates that the future state may result in less venues, with the landscape comprised of a more distinct collection of unique liquidity pools. This naturally points to the continued significance of large, diversified pools that large market-making banks can support. The increased use of independent analytics and more transparency provides investors with greater comfort when executing in such ‘darker’ venues. Indeed, a number of voices across the industry are questioning the post MiFID II drive for OTC markets to follow an equity market structure path into multi-lateral lit central limit order books, and specifically asking the question whether this lends itself to achieving best execution for the end investor.

The same argument may also be applied to the algo product proliferation, especially given the general investor desire for simplicity, coupled with performance, a perfect example of ‘having your cake and eating it’. However, increasing regulatory obligations on the buy-side, for example the Senior Managers Regime in the UK, will probably reinforce the requirement for complete transparency on how an algo is operating, and the liquidity sources that it is interacting with.

A final conclusion from the study is how difficult it is to aggregate data within the FX market given the lack of standard nomenclature and definitions e.g. we see one of the primary venues described in 6 different ways within BestX. Establishing some standard market conventions, including naming conventions for venues, liquidity providers and standard definitions of time stamps across the trade lifecycles, would be extremely beneficial to the industry!